Gallery

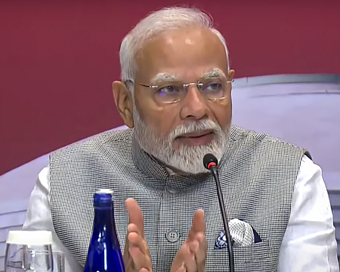

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

PMC Bank scam: SC stays HC order on sale of HDIL assets Last Updated : 07 Feb 2020 03:40:14 PM IST

PMC Bank scam protests The Supreme Court on Friday stayed the Bombay High Court order on the sale of the bankrupt Housing Development and Infrastructure Ltd (HDIL) as a measure to facilitate the repayment of dues of crisis-hit Punjab and Maharashtra Cooperative (PMC) Bank.

RBI moved the top court in an appeal challenging the Bombay High Court order.A bench headed by Chief Justice S.A. Bobe and comprising justices B.R. Gavai and Surya Kant took note of this appeal and issued notice on RBI's plea to parties concerned, including Sarosh Damania, who had moved the Bombay High Court seeking a resolution ensuring payment of dues to the account holders in PMC Bank.According to the RBI, the PMC Bank manipulated its core banking system to shield nearly 44 problematic loan accounts, which includes HDIL. Limited staff members had access to these accounts. Enforcement Directorate (ED) and the Economic Offences Wing of the Mumbai police have registered offences against HDIL promoters and senior bank officials.The Bombay High Court had constituted a three-member committee for evaluating and then formalize sale of encumbered assets of HDIL. The High Court, through this channel, was expected to expeditiously recover dues, which were payable by the firm to PMC Bank.In September 2019, the RBI discovered the PMC Bank had allegedly created fictitious accounts to mask loans to the tune of Rs 4,355 crore approved for HDIL.A PIL was filed in the High Court urging the court to pass directions for expeditious disposal of HDIL assets and properties, which were attached by various investigating agencies. The PIL contended the disposal of these assets would help in repaying PMC Bank depositors at the earliest.Last month the Supreme Court had also stayed a Bombay High Court order connected with the shifting of the two main accused of the Punjab & Maharasthra Cooperative (PMC) bank scam, from Arthur Road jail to their residence to enable them to sell their assets.The Enforcement Directorate rushed to the apex court challenging the relief granted to PMC bank scam accused and HDIL directors.The Bombay High Court had ordered setting up of a three-member committee to conduct valuation and sale of encumbered assets of HDIL to recover the dues, which the firm is supposed to pay to the crisis-hit PMC Bank.The High Court allowed the HDIL's father-son duo, Rakesh and Sarang Wadhawan, to shift to their house from jail under supervision of two jail guards and to ensure their cooperation with the investigating agencies.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186