Gallery

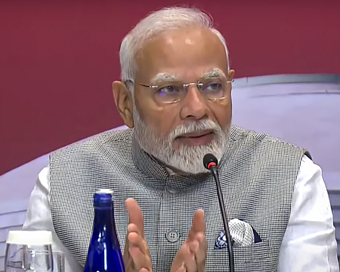

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Yes Bank crashes 72% after RBI takes charge Last Updated : 06 Mar 2020 12:38:51 PM IST

Yes Bank (file photo) Private lender Yes Bank lost nearly three-fourth of its share value during Friday's early trade after RBI superseded its board on Thursday.

At 11.37 a.m., Yes Bank shares plunged over 72 per cent to Rs 10.20 a share.The SBI board had given the largest lender an "in-principle" approval to invest in the capital-starved Yes Bank.The central bank has also imposed a moratorium on the private lender till April 3, 2020. Withdrawals from the bank have been capped at Rs 50,000 per depositor.Moody's on Yes Bank had said that RBI's moratorium on Yes Bank is credit negative as it affects timely repayment of bank depositors and creditors.While Moody's expects Indian authorities will take steps to prevent the weakness in the bank's viability from significantly impacting its depositors and senior creditors, the lack of a coordinated and timely action highlights continued uncertainty around bank resolutions in India.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186