Gallery

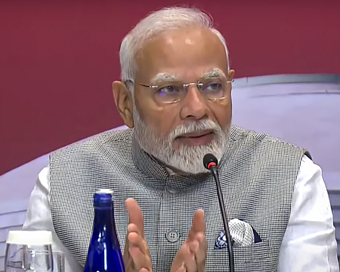

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Oil companies to report big losses as lockdown shrinks sales Last Updated : 09 Apr 2020 02:13:33 PM IST

file photo State-owned oil marketing companies (OMCs) including Indian Oil, BPCL, HPCL may see significant erosion in the earnings during the January-March quarter of FY20 even though low crude and product prices jacked up their margins on the sale of petrol and diesel.

According to a research report by ICICI Direct, the unusually high gross refining margins reported by OMCs have already seen a fall in the Q4 period and coupled with inventory losses that the companies would report during the period, would lead to a further drop in GRMs and consequently impact their revenues.Companies make inventory losses in a falling market as the cost of the inventory in the form of crude and products is higher that the prevailing prices.The projection is that BPCL may report a net loss of Rs 556.2 crore in Q4, while Indian Oil may report significantly higher losses at Rs 2376.3 crore. ICICI Direct has projected loss to the tune of Rs 628.4 crore for HPCL in January-March quarter of FY20."For Indian refiners, spreads of gas oil, gasoline and jet fuel are more important and have declined in the current quarter. The spread for gas oil declined by $1.9/bbl (per barrel) from $12.8/bbl to $10.9/bbl, which will negatively impact GRMs QoQ (quarter on quarter)," the report said.In respect of products, the spreads for petrol declined by $8.7/bbl QoQ from $15.8/bbl to $6.8/bbl and for jet fuel by $6/bbl QoQ from $14.7/bbl to $8.7/bbl. This is a significant fall which together with inventory losses could put severe stress on OMCs financials.The government initiated a nationwide lockdown towards the end of March for three weeks putting restrictions on travel as part of efforts to contain the spread of coronavirus. This itself has resulted in fall in the marketing segment volumes resulting in 10-15 per cent overall decline in sales year-on-year. All the three OMCs -- IOC, BPCL and HPCL have seen their marketing volumes declining between 12-15 per cent in Q4. Their refining throughput has already fallen in the January-March quarter."The marketing segment reported inventory losses during the quarter. However, high core marketing margins QoQ will provide respite to OMCs as the cost benefit has not been fully passed on to consumers," ICICI Direct said.The present situation has also resulted in declining sales in the City gas distribution segment. City gas distribution (CGD) companies' sales volumes are expected to take a hit during the quarter due to reduced sales on account of nationwide lockdown in March. These restrictions will affect CNG & industrial/commercial PNG sales. But domestic PNG sales volume will continue to report steady growth.A decline in gas prices will lead to higher gross margins YoY for all CGD companies. For large gas utility companies also, volumes are expected to fall due to lower demand mainly in March.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186