Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

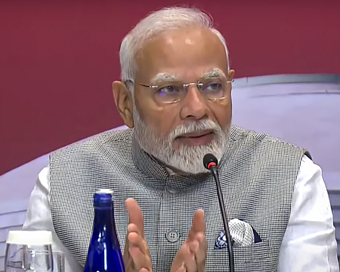

Rs 30,000 crore special liquidity scheme for NBFCs, HFCs and MFIs: FN Last Updated : 13 May 2020 06:33:03 PM IST

Finance Minister Nirmala Sitharaman Finance Minister Nirmala Sitharaman on Wednesday announced a Rs 30,000 crore special liquidity scheme for non-banking finance companies (NBFCs), housing finance companies (HFCs) and micro-finance institutions (MFIs).

Speaking to the media here, Sitharaman noted that these finance institutions are finding it difficult to raise money in debt markets and many institutions have not been able to take advantage of the recent relaxations given by the government and the Reserve Bank of India.Under the scheme, investments will be made in both primary and secondary market transactions in investment grade debt paper of these institutions.She said that the scheme will support the previous initiatives of the government and the central bank to boost liquidity.The securities under the scheme will be fully guaranteed by the Central government.As per the government, the scheme would provide liquidity support to mutual funds along with NBFCs, HFCs and MFIs and create confidence in the market.Further, the government has also announced Rs 45,000 crore partial credit guarantee scheme for NBFCs.Under the scheme, first 20 per cent loss will be borne by Cenre, and even unrated papers will be eligible for investment, enabling NBFCs to reach out even to MSMEs in far-flung areas.The step has been taken as NBFCs, HFCs and MFIs with low credit rating require liquidity to do fresh lending to MSMEs and individuals.The measure is a part of the Rs 20 lakh crore economic package announced by Prime Minister Narendra Modi on Tuesday evening.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186