Gallery

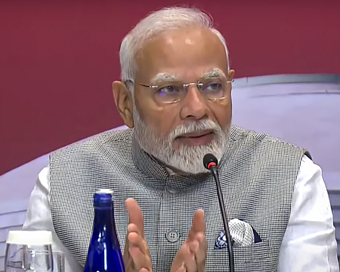

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

Banks may not extend second moratorium to all customers Last Updated : 23 May 2020 03:20:42 PM IST

file pic Banks may not extend second moratorium to all their customers amid gradual resumption in business activity and rising asset quality risk emerging from longer duration loan forbearance.

Sources said that banks are evaluating their loan portfolio with regard to customers who availed moratorium of interest repayment during the fist instalment period of March 1 to May 31. Fresh extension on moratorium will be offered only to certain clients with good track record and healthy business operations."Unlike the first round, banks will now be extending the moratorium selectively (1m-3m) basis to new/old customers, while good customers too will be reluctant, given the higher interest cost and some pick-up in business activity," said Emkay Global in a report prepared after talking to several bankers on the fresh announcements by the Reserve Bank of India (RBI).As part of COVID-19 relief package, the RBI on Friday extended the moratorium on term loans and interest on working capital loans by three months till August 31. Also, as a relief for working capital borrowers, it allowed conversion of accumulated interest on these loans to Funded-Interest Term Loan (as typically happens under restructuring) instead of one-shot payment at the end of the moratorium, but still payable before March 31, 2021.Bankers are indicating that instead of the 3 month moratorium, forbearance on asset classification or selective restructuring (mainly for SME) would have been a better solution, with business activities resuming gradually. Longer moratoriums are acceptable for long-tenure loans like mortgage, but not for short-tenure loans, and also disrupts credit discipline even for relatively good customers in the long run, the brokerage said in its report on the basis of comments from bankers.It is now expected that that salaried class, which was relatively reluctant in the first round, may opt for a moratorium in the second round due to rising job losses/pay cuts.Moratorium behaviour from corporates was mixed in the first round, with even good rated corporates availing moratorium, but may not take the extension.Collection from micro finance segment borrowers still remains slow due to restriction in conducting centre meetings and thus, banks may selectively extend a short moratorium on need basis in specific areas, the brokerage said.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186