Gallery

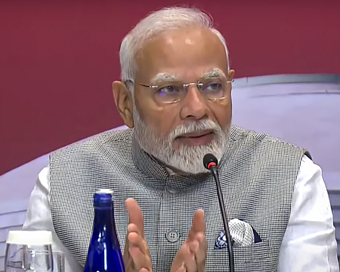

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

Doubts raised on transparency of two PM funds, LS passes Taxation Bill Last Updated : 20 Sep 2020 12:50:26 AM IST

Lok Sabha The Lok Sabha on Saturday passed Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020 amid counter allegations levelled by both the BJP and the Congress members on their top party leadership.

Linking the present government's PM CARES Fund and Prime Minister National Relief Fund (PMNRF) set up by India's first Prime Minister Jawaharlal Nehru in 1948, both the parties raised suspicion over transparency of both the funds.The cross allegations created uproar for the second consecutive day in the lower House when Union Minister of State Anurag Thakur on Saturday again raised question on the transparency of PMNRF alleging Congress of utilising the money received in the fund for the benefit of Nehru-Gandhi family while participating in the debate over the Bill which was moved by Finance Minister Nirmala Sitharaman on Saturday for consideration and passage.The Minister made allegation against Congress' interim President Sonia Gandhi and her family of utilising the fund of PMNRF being members of the trust.He also alleged that funds received in PMNRF were transferred in Rajiv Gandhi Foundation and from their it was transferred into various other trusts.Thakur also alleged that fugitive controversial televangelist Zakir Naik donated Rs 50 lakh into Sonia Gandhi-led Rajiv Gandhi Foundation in 2011.Though the amount was returned in 2014 it clarified links of the party with Naik, Thakur alleged.However, the Congress raised questions on creation of PM CARES when PMNRF was already present and it was used to help states during various disasters from 2015 to till now.Congress leaders Adhir Ranjan Chowdhury and Gaurav Gogoi alleged that there are many "loopholes" in Prime Minister's Citizen Assistance and Relief in Emergency Situations (PM-CARES) fund.The party also sought details of Vivekanand Foundation and some other trusts related to the BJP.The Bill was later passed with voice vote during over four hour long counter allegations by both the parties on each other.The Bill was introduced in the Lok Sabha on Friday to replace the Taxation and other Laws (Relaxation of Certain Provisions) Ordinance, 2020 which was promulgated on March 31 this year.Speaking on the Bill, Sitharaman said we are raising questions on Rajiv Gandhi Foundation because Congress gave money to the trust from PMNRF.Countering Congress allegations, the Minister said what names the party has taken are not given money from PM-CARES fund on which the opposition has raised question on several occasions earlier after it was set up to undertake and support relief or assistance of any kind relating to a public health emergency during the Covid-19 pandemic."You are a responsible political party. Don't spread rumours. It's not good for your credibility."Citing Rafale fight jet deal, the Minister said Congress indulged in "rumour mongering" and it got back replies. "You will again get answers."The government came with the Bill which seeks to amend the Income-tax Act, 1961, the Central Goods and Services Tax Act, 2017; the Finance Act, 2019; the Direct Tax Vivad se Vishwas Act, 2020 and the Finance Act, 2020 which are administered by the Department of Revenue through two boards, namely, the Central Board of Direct Taxes and the Central Board of Indirect Taxes. Thus, no additional expenditure is contemplated on the enactment of the Bill.The Bill provides for extension of various time limits for completion or compliance of actions under the specified Acts and reduction in interest, waiver of penalty and prosecution for delay in payment of certain taxes or levies during the specified period.The Finance Act, 2020 is also proposed to be amended to clarify regarding capping of surcharge at 15 per cent on dividend income of the Foreign Portfolio Investor.The Bill also proposes to empower the Central government to remove any difficulty up to a period of two years and provide for repeal and savings of the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186