Gallery

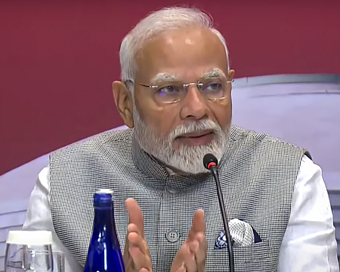

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

RBI rationalises risk weights of individual home loans to boost liquidity Last Updated : 09 Oct 2020 02:07:28 PM IST

File Photo In a bid to improve liquidity for home buyers and boost realty demand, the Reserve Bank of India (RBI) has decided to rationalise the risk weights of new individual home loans sanctioned up to March 31, 2022.

Under the extant regulations, differential risk weights are applicable to individual housing loans, based on the size of the loan as well as the loan-to-value ratio (LTV).Addressing the media after the Monetary Policy Committee's bi-monthly meeting, RBI Governor Shaktikanta Das said: "In recognition of the role of the real estate sector in generating employment and economic activity, it has been decided to rationalise the risk weights and link them to LTV ratios only for all new housing loans sanctioned up to March 31, 2022."He noted that the move is expected to give a fillip to the real estate sector.Realty players have hailed the decision which would boost liquidity for the prospective home buyers."The linking of risk weight of home loans to LTV for all new housing loans is a step in the right direction, this will benefit the real estate sector," Krish Raveshia, CEO, Azlo Realty said.

IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186