Gallery

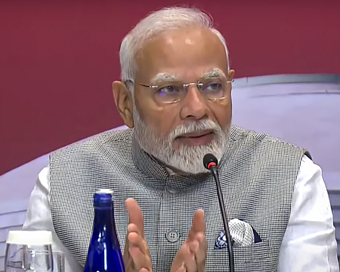

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Paytm enters credit card biz, to issue 20 lakh cards in 12-18 months Last Updated : 19 Oct 2020 06:50:25 PM IST

Paytm Leading digital financial services platform Paytm on Monday said it will partner with various card issuers to introduce co-branded credit cards and is aiming to issue 20 lakh cards in the next 12-18 months.

The move is aimed at transforming the credit market by enabling "new to credit" users to join the digital economy, the company said."In our country, credit cards are still considered a product for the affluent sections of the society and not everyone can avail of its benefits. At Paytm, our aim is to provide credit cards that benefit India's aspiring youth and evolved professionals," Bhavesh Gupta, CEO - Paytm Lending, said in a statement."These cards are designed to help them lead a healthier financial life through managing and analysing spends to make well-informed decisions. This can transform the credit market by bringing 'new to credit' users into the formal economy."Given the limited access to banking, stringent documentation and long processing times, India's credit card penetration stands at only three per cent compared 320 per cent in markets such as the US.With its digital application process, alternate (spends based) underwriting, and minimal documentation, Paytm said it aims to democratise the credit card access for masses and plans to capture at least 10 per cent of this largely untapped market.Paytm said it is designing an innovative digital experience on its app allowing users to manage their overall spends and have full control over the card usage.The digital payments company said its credit card will provide insurance protection against fraudulent transactions to protect users' money.The company plans to issue the cards based on both traditional credit score and user's purchase patterns on Paytm.The company last week announced the same-day settlement facility for all kinds of fund transfers on its payment gateway that will help businesses that depend upon immediate availability of funds to pay down-stream partners.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186