Gallery

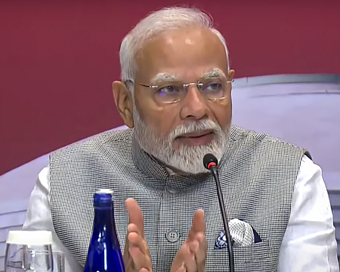

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

CBI raids several locations in 2 separate bank fraud cases worth Rs 8,200 cr Last Updated : 18 Dec 2020 11:39:37 PM IST

CBI The Central Bureau of Investigation (CBI) has filed cases against a Hyderabad-based company, Transstroy (India) Ltd, for allegedly cheating a consortium of banks of Rs 7,926 crore, and against a Chennai based company for cheating the bank to the tune of Rs 313.79 crore, officials said on Friday.

According to officials, fugitive diamantaire Nirav Modi, who is currently lodged in a UK jail and is facing extradition charges, is wanted in the Punjab National Bank fraud case for cheating the bank to the tune of Rs 7,700 crore.A CBI official said that the agency has registered a case against Hyderabad-based Transstroy (India) Ltd, its chairman and managing director Cherukuri Sridhar, Additional directors Rayapati Sambasiva Rao and Akkineni Satish, unknown public servants and unknown others on a complaint from Canara Bank.The official said that it was alleged that the private firm based at Hyderabad and its directors had availed credit facilities on multiple banking arrangements. The consortium was formed with other banks, led by Canara Bank, the official said.The official said it was further alleged that the accused had been involved in falsification of books of accounts, fudging of stock statements, tampering of balance sheets, round tripping of funds etc.The official said that the accused misappropriated bank funds and diverted the loan amount sanctioned and caused loss of Rs 7,926.01 crore to Canara Bank and other member banks. The account had become NPA and the fraud was reported."Searches were conducted at the premises of the company and other accused at Hyderabad and Guntur, which led to recovery of incriminating documents," the official said.Meanwhile, the second case has been registered against Chennai-based Agnite Education Ltd., its chairman K. Balasubramaniam, director K. Padmanabhan, unknown public servants and private persons on a complaint from State Bank of India.In the complaint it has been alleged that the borrower company represented by its Chairman and Director availed Credit limits of Rs 310 crore from SBI.However, the loan amounts were diverted to related parties and the account became NPA and declared as fraud, the official said.The CBI carried out searches at the premises of the accused at Chennai which led to recovery of incriminating documents.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186