Gallery

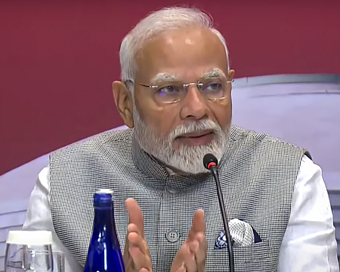

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

No formal communication from SEBI on Adani Wilmar IPO being kept in abeyance: Adani Group Last Updated : 21 Aug 2021 03:22:55 PM IST

The Adani Group has said that it has not received any formal communication from the Securities & Exchange Board of India (SEBI) with respect to Adani Wilmar initial public offering (IPO) observations being kept in abeyance.

The Capital markets regulator has kept the proposed Rs 4,500-crore initial share-sale of edible oil major Adani Wilmar Ltd (AWL) in "abeyance". Without disclosing the reason, Sebi said "issuance of observations kept in abeyance" with regard to the Adani Wilmar IPO, according to an update in the SEBI website as on August 13." SEBI has put on its website that Adani Wilmar IPO 'Issuance of observations kept in abeyance'. However, we have not received any formal communication from SEBI with respect to the IPO observations being kept in abeyance," a spokesperson of Adani Group said."While we have always been fully compliant with applicable SEBI Regulations, we have made full disclosure to SEBI on specific information requests from them in the past. We will continue to co-operate with the regulators in the future as well," the spokesperson added.Wile the regulator has not given reasons, reports have suggested that Adani Wilmar IPO was put on hold due to an ongoing investigation into the group's flagship company, Adani Enterprises. Gautam Adani-led Adani Enterprises holds 50 per cent stake in Adani Wilmar, which owns the popular edible oil brand 'Fortune'.During the monsoon session of the Parliament, Minister of State for Finance, Pankaj Chaudhary said that the SEBI is investigating some Adani group companies with regard to compliance with SEBI regulations while the Directorate of Revenue Intelligence is also probing certain entities under the laws administered by it.However, the minister added that the Enforcement Directorate is not probing these companies.The Adani Group spokesperson said that the group has no connection with FPIs, either directly or indirectly and these are investors like other investors/shareholders in Adani Group and act independently having no relationship with Adani Group.As per the SEBI rules, if one of the departments of the regulator is investigating in a company, its related entity may not receive the regulator's approval for 90 days, which can further extend by 45 days. Adani Wilmar's biggest business is edible oil, which is a high-volume but low-margin segment. The company's flagship Fortune brand is among the largest oil brands.As per the SEBI (Issuance of Observations on Draft Offer Documents Pending Regulatory Actions) Order, 2020, issued by the SEBI on February 5, 2020, the regulator is obligated to keep issuance of observations in abeyance for a period of 30 days or 45 days or 90 days or more, as the case may be.Adani Wilmar is a joint venture of Adani Group and Singapore's Wilmar Group.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186