Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

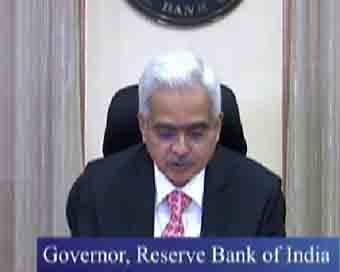

RBI hikes repo rate by 40 bps; CRR increased by 50 bps Last Updated : 04 May 2022 03:57:37 PM IST

Reserve Bank of India Governor Shaktikanta Das on Wednesday said that the Monetary Policy Committee (MPC) of the central bank, in an off-cycle meeting, hiked the repo rate by 40 basis points (bps) to 4.40 per cent with immediate effect.

Repo rate is the rate at which the central bank lends short-term funds to banks. The RBI has cut the repo rate by 250 basis points since February 2019 to help revive the growth momentum. The Monetary Policy Committee has been on a prolonged accommodative stance to support the growth.Also, the case reserve ratio has been hiked by 50 basis points to 4.5 per cent.The move was taken in order to contain inflation.The ongoing geopolitical tensions are pushing inflation higher in major economies besides the crude oil price also being volatile and above $100 per barrel.Edible oil shortage is due to the conflict and ban by exporters, said Das."The decision today to raise the repo rate may be seen as a reversal of rate action of May 2020. Last month, we had set out a stance of withdrawal of accommodation. Today's action needs to be seen in line with that action," Das said."I would like to emphasise that the monetary policy action is aimed at containing inflation spike and re-anchoring inflation expectation," Das said. "High inflation is known as detrimental to growth."Das, however, added that monetary stance remains accommodative and actions will remain calibrated.Most importantly, the unscheduled announcement by the central bank surprised the equity markets as it nose-dived right after.Sensex tanked nearly 1,100 points, whereas Nifty over 300 points.IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186