Gallery

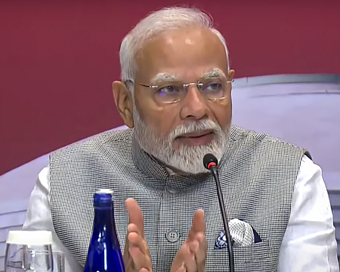

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

Stock Market News: Indices extend losses; Sensex, Nifty shed over 1% each Last Updated : 07 Jun 2022 11:18:21 AM IST

Domestic indices on Tuesday extended their losses from the previous session as the overall sentiments still remain cautious amongst investors as they are worried about inflation and benchmark interest rates, said analysts.

At 10.02 a.m., Sensex was 1.1 per cent down at 55,037 points, whereas nifty down 1.1 per cent at 16,388 points.

The three-day Reserve Bank of India's (RBI) monetary policy review meeting that started on Monday will have a bearing in the market movement going ahead.Though the RBI raising policy rates in the ongoing monetary policy committee meeting is a "no brainer", as said by its Governor Shaktikanta Das in a recent interview, investors, however, await the actual degree of percentage hike before taking fresh positions and future course of action in the financial markets."Two crucial numbers coming this week are significant, RBI's rate hike tomorrow and the inflation rate in the US expected on Friday. RBI's rate hike is a foregone conclusion; the only unknown is the quantum of the rate hike. Even if the rate hike is by a steep 50bp, the market is unlikely to be impacted much since frontloading of the rate hike will be more effective in anchoring inflation expectations," said V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.The market direction is likely to be influenced more by the inflation in the US, which, in turn, will decide how far the US Fed will go in raising rates because it be the key determinant of possible 'risk on' or 'risk off' in equity markets globally, said Vijayakumar."Rising rate scenario will improve the margin of the banking sector since deposit rates lag lending rates. The most attractively valued segment in the market now is financials, particularly banking."IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186