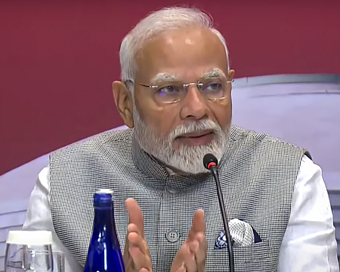

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Infamous Hindenburg, which targeted Adani Group, faced intense scrutiny from Indian regulators Last Updated : 16 Jan 2025 01:40:11 PM IST

Infamous Hindenburg, which targeted Adani Group, faced intense scrutiny from Indian regulators Infamous short-selling firm Hindenburg Research, which is now being disbanded as per an open letter from its founder Nate Anderson, has been under the radar of Indian regulators like the Securities and Exchange Board of India (SEBI) over its report against the Adani Group, which was dismissed by the Supreme Court.

The Adani Group always vehemently rejected allegations by Hindenburg Research as “malicious, mischievous and manipulative selections of publicly available information" to arrive at "pre-determined conclusions for personal profiteering with wanton disregard for facts and the law”.

“For a discredited short-seller under the scanner for several violations of Indian securities laws, Hindenburg's allegations are no more than red herrings thrown by a desperate entity,” according to the Group.

The SEBI last year issued a show-cause notice to Hindenburg Research, Nate Anderson and the entities of Mauritius-based foreign portfolio investor Mark Kingdon for trading violations in the scrip of Adani Enterprises Ltd leading up to Hindenburg Report.

The regulator alleged that Hindenburg and Anderson violated regulations related to fraudulent and unfair trade practices and the code of conduct for research analysts.

According to the show cause notice, SEBI alleged that prior to the report release, short-selling activity was witnessed in the futures of Adani Enterprises and after the report the share lost 59 per cent between January 24, 2023 and February 22, 2023.

The SEBI investigation revealed that K-India Opportunities Fund – Class F opened a trading account and started trading in the scrip of Adani Enterprises before the release of the report. The FPI then squared off the positions in February making a profit of $22.25 million or Rs 183.24 crore.

Hindenburg continued to defend its January 2023 report. The Adani Group denied allegations levelled by the short seller.

The Supreme Court in July last year dismissed a review petition that was filed against its January 3 judgement in the Adani Group-Hindenburg Research case, wherein the court reposed confidence in SEBI's regulatory powers and ruled that petitioners could not provide enough material to transfer the probe to a special investigation team.

In January last year, the Supreme Court refused to form any SIT or group of experts to conduct an investigation into the Adani-Hindenburg controversy, saying that the media and third-party reports were not conclusive proof.

“SEBI should take its investigation to its logical conclusion in accordance with law. The facts of this case do not warrant a transfer of investigation from SEBI,” held a bench presided over by then CJI, D.Y. Chandrachud.

Despite continuous attacks from Hindenburg Research and other US-based entities in the past, the market cap of the Adani Group has increased to nearly Rs 12.80 lakh crore.

Every attack made the Group even stronger, and every obstacle became a stepping stone for a more resilient conglomerate. In the recent past, there have been many positive developments about Adani Group's companies that boosted investors’ confidence.IANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186