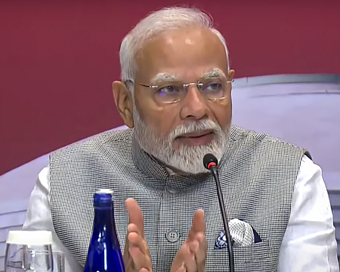

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

PNB fraud: Ex-Deputy Bank Manager Gokulnath Shetty arrested Last Updated : 17 Feb 2018 01:13:28 PM IST

(file photo)

The Central Bureau of Investigation (CBI) has arrested Punjab National Bank's retired Deputy Manager, Gokulnath Shetty and two others in a multi-crore bank fraud case, officials said on Saturday.

"CBI has Shetty, Single Window Operator Manoj Kharat and authorised signatory of the Nirav Modi Group of Firms, Hemant Bhat," a CBI official said.

The official said that they will be presented before the CBI special court in Mumbai later in the day.

PNB's retired Deputy Manager and Operator are named in the CBI FIR along with 10 directors of the three private firms namely Krishnan Sangameshwaran, Nazura Yashjaney, Gopal Das Bhatia, Aniyath Shivraman, Dhanesh Vrajlal Sheth, Jyoti Bharat Vora, Anil Umesh Haldipur, Chandrakant Kanu Karkare, Pankhuri Abhijeet Varange and Mihir Bhaskar Joshi.

According to the FIR, it was alleged in the PNB complaint that Gitanjali Gems, Gili India Ltd and Nakshatra Brand Ltd and their directors in connivance with Sethi and other officials had caused an alleged loss of Rs 4,886.72 crore to the bank.

The CBI on Friday registered fresh FIRs against 10 directors of the Gitanjali Group of companies under charges of criminal conspiracy and cheating of Indian Penal Code and Prevention of Corruption Act against Mehul Choksi, the Managing Director of Gitanjali Gems Ltd based at Mumbai's Walkeshwar.

The FIR has also named two former bank employees who were said to be directly involved in the fraudulent transactions.

Additionally, three companies of Gitanjali Group were also named in the CBI FIR registered on Thursday for causing alleged loss of Rs 4,886.72 crore.

The Enforcement Directorate (ED) on Thursday launched a nation-wide raid on the offices, showrooms and workshops of billionaire diamond trader Nirav Modi.

The multi-pronged action came a day after the Punjab National Bank admitted to unearthing a fraud of Rs 11,515 crore involving Nirav Modi's companies and certain other accounts with the bank's flagship branch (Brady House Branch) in Mumbai and its second largest lending window in India.

The fraud, which includes money-laundering among others, concerns the Firestar Diamonds group in which the CBI last week booked Modi, his wife Ami, brother Nishal Modi and their uncle Mehul Choksi.IANS For Latest Updates Please-

Join us on

Follow us on

172.31.16.186