Gallery

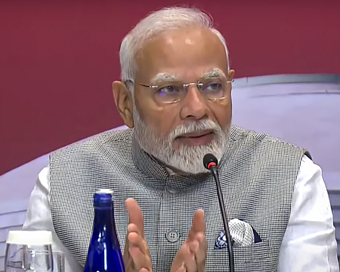

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

Union Budget 2022-23: Key highlights from the session Last Updated : 01 Feb 2022 02:42:06 PM IST

Indian Finance Minister Nirmala Sitharaman Budget 2022 highlights: Indian Finance Minister Nirmala Sitharaman said on Tuesday that the budget for 2022/2023 will lay the foundation for economic growth through public investment as Asia's third-largest economy emerges from a pandemic-induced slump.

India’s economic growth in FY22 to be at 9.2 per cent, highest among all large economies, said FM in her address. India in a strong position to withstand challenges due to higher vaccinations, she added.

Here are the key changes announced by FM Sitharaman-Income from virtual digital assets to be taxed at 30%-Income from transfer of digital assets to be charged 30% tax, plus 1% tax on the transaction-To launch digital rupee using blockchain technology starting 2022/23-To launch a scheme for the taxation of virtual digital assetsLosses from the sale of virtual digital assets cannot be offset against other income

Taxpayers can now update I-T returns within 2 yearsTo provide an opportunity to correct an error, taxpayers can now file an updated return within 2 years from the relevant assessment year: FM Nirmala Sitharaman

Corporate surcharge to be reduced from 12% to 7%Corporate surcharge to be reduced from 12% to 7%, says Finance Minister Nirmala Sitharaman

LTCG to be taxed at 15%Income from Long Term Capital Gains will be taxed at 15%

FM announces 35.4% increase in capital expenditureCapital Expenditure to increase 35.4% from ₹5.54 lakh crore to 7.50 lakh croreSpectrum auctions this year to enable 5G roll out by 2023Required spectrum auctions will be conducted in 2022, to facilitate the roll-out of 5G mobile services by private telecom players, says SitharamanCapital expenditure to be around Rs 10.68 lakh croreEffective capital expenditure of the Central government is estimated at Rs 10.68 lakh crore in 2022-23, about 4.1% of GDP: FM Nirmala SitharamanDigital rupee to be issued by RBI in the upcoming yearDigital rupee to be issued using blockchain and other technologies and will be issued by RBI starting 2022-23. This will give a big boost to the economy: FM Nirmala Sitharaman

Growth estimated to be 9.2%India's growth is estimated to be at 9.2%, the highest among all large economies; we are now in a strong position to withstand challenges, says FM

E-passports, ease of business 2.0Issuance of E-passports will be rolled out in 2022-23 to enhance convenience for citizens. Ease of business 2.0 will be launched.FM's announcements on digital education, digital universityFor classes 1 to 12, 1 class 1 Tv channel will be extended from 12 to 12,000 TV channels, announced Nirmala Sitharaman, considering the loss of the education system due to the pandemic.68% of the capital procurement budget for Defence to be earmarked for domestic industry68% of the capital procurement budget for Defence to be earmarked for domestic industry to promote Aatmanirbharta and reduce dependence on imports. This is up from the 58% last fiscal: FM Nirmala SitharamanKen Betwa linking project to cost around Rs 44,605 croreImplementation of the Ken Betwa Linking project at an estimated cost of Rs 44,605 crore to be taken up with irrigation benefits to 9 lakh hectare farmland, drinking water to 62 lakh people, 103 MW hydropower and 27 MW solar power generation: Nirmala SitharamanRs 1 lakh crore allocated to states to help investmentsFor 2022-23, an allocation of Rs 1 lakh crore has been made to assist the states in catalysing overall investments in the economy. These 50-year interest-free loans are over and above normal borrowings allowed to states. It'll be used for PM Gati Shakti-related and other productive capital investments of states: FMRs 48,000 crore allocated for completion of construction of 80 lakh housesRs 48,000 crores allocated for completion of construction of 80 lakh houses under PM Awas Yojana in rural and urban areas in the year 2022-23

Additional allocation of Rs 19,500 crore for manufacturing solar modulesTo facilitate domestic manufacturing of 280 gigawatts of installed solar capacity by 2030, an additional allocation of Rs 19,500 crore for PLI for manufacturing of high-efficiency modules with priority to fully integrate manufacturing units to solar PV modules will be made: FMTax deduction limit to be increased from 10% to 14% for Centre, state govt employeesBoth Centre and States govt employees' tax deduction limit to be increased from 10% to 14% to help the social security benefits of state government employees and bring them at par with the Central govt employees

Customs duty on the diamond to be reduced to 5%Customs on polished diamonds, gemstones cut to 5%. Simply sawn diamonds will be exempted. To facilitate the export of jewellery through e-commerce, simplified regulations will be in place by June this year

January gross GST collection highest since the inception of taxThe gross GST collections for January 2022 are Rs 1,40,986 crore —the highest since the inception of the tax: Finance Minister NirmalaVande Bharat trains400 new-generation Vande Bharat trains with higher efficiency and better facilities for passengers will be developed in the next three yearsIANS New Delhi For Latest Updates Please-

Join us on

Follow us on

172.31.16.186